WHERE THEY STAND

Canadians have little time left to decide which party's promises best fit with their own visions for the country. Here is what the parties have promised on some key issues:

BY THE CANADIAN PRESS

THE LIBERALS

Climate Change and Environment

Maintain a carbon tax until 2022, at which point it will sit at $50 per tonne of carbon-dioxide emissions. Their goal is net-zero emissions by 2050. To get there, they're committing to incentivizing green technology by cutting corporate tax rates in half for companies that create clean technology, promoting green home retrofits and planting two billion trees over the next decade. They've also proposed banning some single-use plastics starting in 2021 at the earliest.

Trans Mountain Pipeline

Use the profits from public ownership of the Trans Mountain Pipeline — and from a possible sale of the pipeline — to fund green projects, and have already approved the twinning project. They have said that they would be open to significant Indigenous ownership of the pipeline in the future.

The deficit

The governing party has no short-term plan to balance the budget, saying it will run a deficit of around $27.4 billion next year and falling to just over $21 billion in 2023-2024. It points to a declining debt-to-GDP ratio as the key indicator of economic and fiscal health, as well as a strong international credit rating. It says the investments it is making through deficit spending are part of a plan for long-term growth.

Taxes and Income

Raise the basic tax-free amount for individuals from $12,069 to $15,000 by 2023. Place a new 10 per cent tax on luxury cars, boats and personal aircraft worth more than $100,000. Continue with a plan to raise the Canada Child Benefit by up to $1,000 for children under the age of one. Implement a $15-an-hour federal minimum wage.

Reconciliation

At the end of the last parliamentary session, Justin Trudeau promised to introduce legislation that would align Canadian law with the United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP). Re-iterated commitment to ending boil-water advisories on First Nations reserves by 2021. Improve outcomes on priorities like infrastructure, health care, child care and preserving Indigenous languages.

Quebec's Bill 21

Trudeau has said he disagrees with the law, which bans the wearing of religious symbols by many public servants. He said a Liberal government will not, as of now, join the current court challenge against Bill 21 — but kept the door open for possibly doing so in the future. He said a federal government should be ready to protect the fundamental rights of Canadians.

Housing

Another Trudeau government would put in place a one per cent speculation tax on vacant residential properties, as well as expand the existing first-time home-buyer incentive to apply to homes worth just under $800,000 in Toronto, Vancouver and Victoria. It would continue to implement the National Housing Strategy developed over the last four years.

Education

Increase the Canada Student Grant by up to $1,200 per year, extend the interest-free grace period on students loans, pause loan payments for graduates making less than $35,000, and pause payments interest-free for new parents.

Child care

Spend $535 million a year to create up to 250,000 more before- and after-school child-care spaces. Reduce fees for those programs by 10 per cent. Remove federal taxes from EI payments on maternity and parental leave and work toward guaranteed paid family leave for people who don't qualify for EI. Increase the Canada Child Benefit by 15 per cent for children under one year old.

Pharmacare

Take steps toward national, universal pharmacare, with a commitment of $6 billion over the next four years. Create an agency to make bulk drug purchases more efficient.

Gun Control

Ban military-style assault rifles and start buyback programs for weapons already legally purchased in Canada. Give municipalities the ability to ban handguns in their jurisdictions.

Electoral and Senate Reform

The authors of the current reforms in the Senate as well as an abandoned electoral-reform process, the Liberals have no major policy proposals in this area in 2019.

Cellphone bills

Cut cellphone and wireless bills by 25 per cent through regulatory action.

Taxing Internet Giants

After resisting the measure during their previous mandate, the Liberals are now proposing a three per cent tax on revenue tech giants collect from online advertising or other user data.

THE CONSERVATIVES

Climate Change and Environment

Repeal the existing carbon tax and replace it with a series of incentives that would look to promote green technology. Large emitters would be forced to invest in clean-tech research. The Conservatives would promote carbon-capture technology, work to end raw sewage dumping and ban export of plastic waste. They also have a plan to promote Canadian energy products internationally, which could displace more emissions-intensive energy sources overseas.

Trans Mountain Pipeline

Help make major energy projects viable again and guarantee the expansion project is built in a responsible way. They've also proposed a national energy corridor, which could move oil and gas east and hydroelectricity west with fewer regulatory hurdles once the master planning was complete.

The deficit

Balance the budget within five years, starting with a deficit in 2020-2021 of $23 billion. It would do so by cutting foreign aid by 25 per cent, eliminating $1.5 billion in corporate subsidies annually, freezing the public service at its current staffing and making the government more efficient. The party would also take the current allocation of infrastructure spending over 12 years and stretch it over 15 years instead.

Taxes and Income

Cut the tax rate from 15 per cent to 13.75 per cent for income between $12,069 and $47,630. Introduce an array of boutique tax credits for public transit, an old-age credit, green technology, and sports and arts programs.

Reconciliation

Name a minister responsible for consulting with Indigenous communities. Work with Indigenous groups to review the Indian Act and other laws and regulations that are "barriers to prosperity."

Quebec's Bill 21

Scheer has said he also disagrees with the law, but his view of Quebec's jurisdiction on the issue is more firm. He said it is a matter for the courts, and his federal government would not intervene.

Housing

Unspecified changes to the mortgage stress test currently in place, as well as allowing a 30-year amortization period on mortgages (up from a maximum of 25 years now).

Education

Increase the federal contribution to RESPs from 20 per cent to 30 per cent, with a cap of $2,500 per year.

Child care

Introduce a tax credit to make EI benefits tax-free for new parents. They've also promised to reintroduce a couple of tax credits previously in place, including a credit up to $1,000 per child for sports programs and $500 per child for arts programs.

Pharmacare

No plan for universal pharmacare.

Gun Control

Repeal some gun measures brought in during the last mandate. Strengthen background checks and invest more in stopping guns at the border. Ensure firearms owners detained under mental-health legislation have their weapons seized.

Electoral and Senate Reform

Return the Senate selection system to its former patronage focus.

Cellphone bills

No specific promises on cellphones, but have criticized the Liberals' focus on regulation.

Taxing Internet Giants

Attempt to level the playing field by applying a three per cent revenue tax on businesses that run a social media platform, search engine or e-commerce business in Canada.

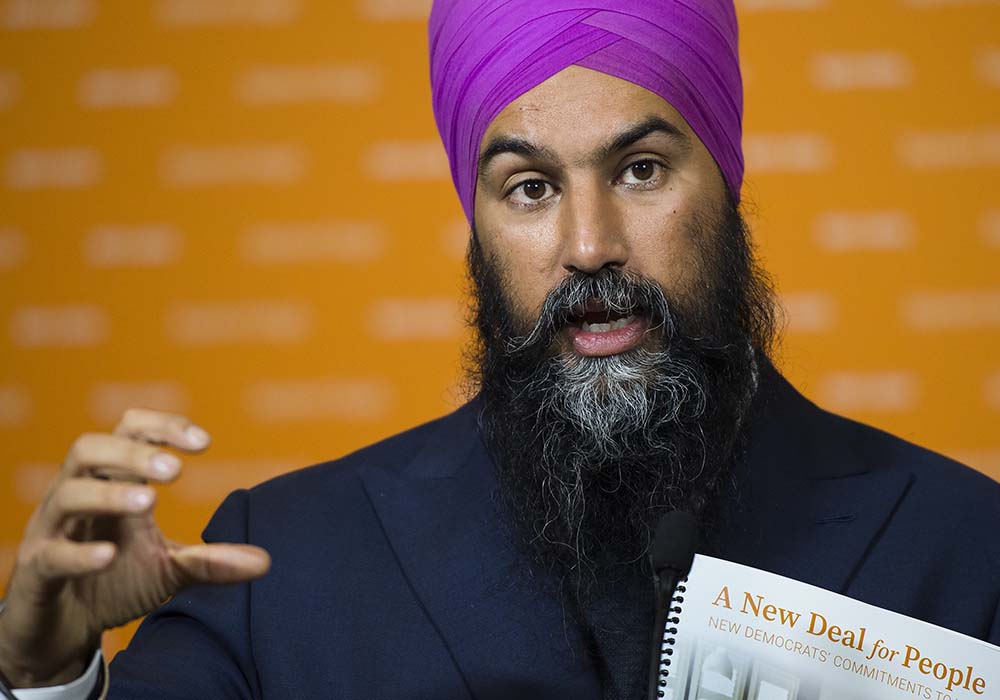

THE NEW DEMOCRATS

Climate Change and Environment

Seek to reduce emissions to 450 megatonnes of carbon — a 37 per cent reduction below 2005 levels — by 2030. They would also commit to have net-zero electricity production in Canada by that same year and achieve completely carbon-free electricity by 2050. They'd ban single-use plastics by 2022, eliminate fossil-fuel subsidies and establish a bank that would promote investment in clean technology. Their plan also has provisions for building-retrofits and expansion of public transit.

Trans Mountain Pipeline

Left the door slightly open to public ownership of the existing pipeline, but wants to scrap the expansion project. Singh has said any proceeds should go to renewable energy projects.

The deficit

No plan to bring the budget back into balance, projecting an approximately $33 billion deficit next year before decreasing to around $16.5 billion in 2023-2024. They also point to a declining debt-to-GDP ratio as the more important economic indicator.

Taxes and Income

Introduce a wealth tax of one per cent on Canadians with wealth over $20 million. They would also raise the top marginal tax rate to 35 per cent and increase the corporate income rate by three percentage points, from 15 to 18 per cent. The NDP would implement a $15 federal minimum wage and launch a universal basic income pilot project.

Reconciliation

Implement UNDRIP and work with Indigenous people to create a national action plan for reconciliation, overseen by a National Council for Reconciliation. Adhere to a standard of "free, prior and informed consent" and invest broadly in Indigenous communities when it comes to health, education, housing and other areas. Spend $1.8 billion to end boil-water advisories on reserves by 2021.

Quebec's Bill 21

Singh has spoken out against the law, calling it legislated discrimination. But he also said the issue is part of Quebec's jurisdiction and he would not intervene. He added that if the court challenge reached the Supreme Court of Canada, it is a responsibility of the government to determine if it would intervene.

Housing

Build 500,000 new affordable housing units over the next decade and implement a national 15 per cent tax on purchases by non-citizens and non-permanent residents. Waive the federal portion of GST/HST on construction of new rental units and reintroduce a 30-year term option for Canada Mortgage and Housing Corporation-insured mortgages on entry-level homes. Double the existing home-buyer's tax credit to $1,500.

Education

Co-operate with provinces to cap and reduce tuition frees with the goal of eventually incorporating colleges and universities into the public education system. Make student loans interest-free.

Child care

Spend $10 billion over the next four years to create 500,000 new child-care spaces. The goal of the program would be to reach a universal system by 2030. That system would include free access for low-income families and up to around $10-a-day cost for higher earners.

Pharmacare

Begin a universal pharmacare (and public dental care) program in 2020. They've promised over $10 billion per year for it.

Gun Control

No specific gun control proposals, focusing instead on investing in anti-gang programs and tackling gun smuggling.

Electoral and Senate Reform

Create a commission to implement mixed-member proportional representation. Lower the voting age to 16. Amend the Constitution to abolish the Senate.

Cellphone bills

Put a price cap on cellphone and Internet bills determined by the average of OECD countries. Require "true" unlimited plans.

Taxing Internet Giants

Impose a three per cent value-added tax and target advertising services and other digital services. The tax would apply to businesses with global revenues of $1 billion and Canadian revenues of over $40 million.

THE GREEN PARTY

Climate Change and Environment

Double Canada's emissions-reduction targets — to 60 per cent below 2005 levels. They would see completely carbon-free electricity nationally by 2030 and are the only party to propose increasing the carbon price, rising $10 per year after 2022. They are targeting an emissions-free economy by 2050. They also have plans for "massive" investments into green retrofits of buildings, incentives for electric vehicles and public transit, and a ban on new internal-combustion passenger vehicles by 2030. The Greens would end fossil-fuel subsidies.

Trans Mountain Pipeline

Strongly against any new pipelines, a Green government would end the expansion project. The party would not approve any new pipelines, coal, or oil and gas projects.

The deficit

Balance the budget over five years, with deficits starting at $40.8 billion in 2020-2021 and decreasing over time.

Taxes and Income

The same wealth tax as the NDP, as well as a six percentage point increase in the corporate rate. They also propose a financial-transactions tax of 0.5 per cent. The Greens would implement a $15 federal minimum wage, as well as start a "Guaranteed Livable Income" program.

Reconciliation

Implement the principles of UNDRIP, as well as the calls to action of the Truth and Reconciliation Commission and recommendations of the Inquiry into Missing and Murdered Indigenous Women and Girls. They're also committed to the "free, prior and informed consent" standard. Scrap the Indian Act through a process led by Indigenous communities and work with Indigenous communities broadly on many issues including climate, health care and infrastructure.

Quebec's Bill 21

Similarly, May opposes Bill 21, but said she would not intervene in the debate currently playing out in Quebec.

Housing

Build 25,000 new and 15,000 rehabilitated housing units each year for the next decade. Dedicate a minister specifically to housing, allow housing construction to be funded through the Canada Infrastructure Bank, and eliminate the first-time home-buyer grant.

Education

Abolish tuition for Canadian students. Forgive the portion of existing student debt held by the federal government and eliminate the two per cent cap on increases to Indigenous education funding.

Child care

Create a road map with provinces and other communities to work toward a universal child care system. Funding for that program would increase until it reaches at least one per cent of GDP.

Pharmacare

Universal pharmacare with a commitment of over $26 billion starting in 2020-2021. Create a bulk purchasing agency and reduce drug patent protection periods. They've also promised free dental care for low-income Canadians.

Gun Control

Start a confidential buyback program for handguns and assault rifles, and prioritize reducing weapons smuggling.

Electoral and Senate Reform

Start moving toward a proportional system and lower the voting age to 16.

Cellphone bills

Use CRTC regulations to increase competition and mandate affordable cellphone plans, as well as bring in antitrust regulation to prevent monopolies.

Taxing Internet Giants

Implement a sales tax on e-commerce companies and ensure tech companies charge and remit GST.